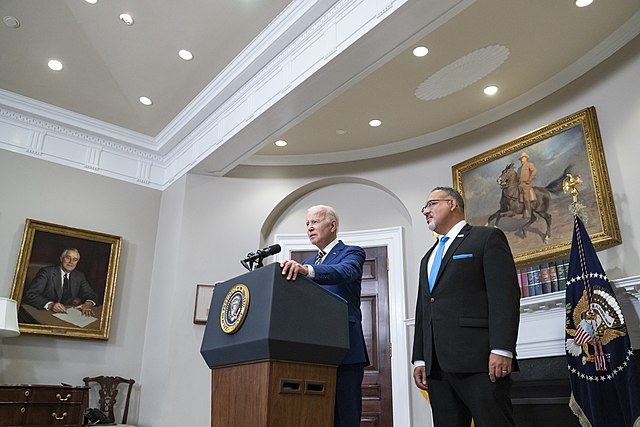

On June 30th, the Supreme Court handed down their much anticipated decision blocking President Biden’s unprecedented student loan cancellation plan. It appears the White House was well aware of this outcome, as they already had their next move ready. Within hours of the SCOTUS ruling, President Biden and Secretary Cardona held a press conference outlining a three-step action plan to help borrowers.

First, they will again try for mass loan cancellation through the Higher Education Act (HEA). Similar to the HEROES Act, it includes provisions allowing the Secretary to make certain changes. While the HEROES Act gave the Secretary the authority to “waive or modify” certain loan provisions during national emergencies, the HEA gives the secretary authority to “compromise, waive, or release federal student loans.” The administration believes this language is likely strong enough to overcome legal scrutiny.

However, it is a long process. The Department of Education must first announce, schedule, and then hold negotiated rulemaking sessions in order to let experts weigh in. This typically takes about six months. Once new policies are written, they must be publicized with advanced notice before taking effect. The usual deadline for this notice is November 1st, with changes taking effect July 1st the following year. In other words, this new approach may not impact borrowers until next summer. The Department of Education will obviously do everything they can to shorten that timeline by looking for loopholes in the language. Even then, we expect to see more legal challenges and more court battles.

Next, the Department of Education will expedite some of the Income Driven Repayment plan enhancements they detailed back in January. The focal point is the revision of the REPAYE plan, which the White House has now dubbed the SAVE plan. This new IDR plan reduces payments and interest for most borrowers, allows married couples to isolate their incomes, and provides a path to (taxable) loan forgiveness in 10 to 25 years. Originally set to take effect in July of 2024, the Department of Education now presumes to have this new repayment plan available before borrowers return to payment in September. Unfortunately, only certain elements of the SAVE plan are being rolled out at this time with the rest scheduled for 2024. We posted a thorough summary of these changes back in January, which we will update in the coming weeks as the situation unfolds.

I will note we have major concerns about loan servicers being able to incorporate these changes in time. There are ongoing reports of servicers being understaffed and underfunded. They have already cut call center hours, and they have their hands full with the One Time Account Adjustment and PSLF Overhaul. So, prepare for a bumpy start.

Finally, Secretary Cardona announced an “on-ramp” for borrowers who struggle to make payments by relaxing the penalties for late, short, or missing payments. From October 2023 through Sep 2024, these borrowers will not be put into default status, have their credit impacted, or be reported to collection agencies. Yet, this is not another payment pause. Interest will accrue during this time, and those who do not make payments will not receive credit towards any sort of forgiveness. Those who are gainfully employed and able to make payments should do so.

The takeaway is that there isn’t a quick workaround the Administration can employ to further extend the pause or enact mass loan cancellation. The pandemic emergency is over (legally), and the recent debt ceiling negotiations have firmed-up the return-to-payment date. We advise all borrowers to solidify their loan payment strategies ASAP between now and August 30th and prepare to start making payments in September/October. Click here to read the detailed action plan from the White House.

Brandon Barfield is the President and Co-Founder of Student Loan Professor, and is nationally known as student loan expert for graduate health professions. Since 2011, Brandon has given hundreds of loan repayment presentations for schools, hospitals, and medical conferences across the country. With his diverse background in financial aid, financial planning and student loan advisory, Brandon has a broad understanding of the intricacies surrounding student loans, loan repayment strategies, and how they should be considered when graduates make other financial decisions.